How to leverage real-time data in financial services

We recently completed a webinar in partnership with the CDP Institute. David Raab, founder of the CDP Institute, and I presented on the topic of "How to leverage real-time data in Financial Services?" We had a few great questions come up to address at the end of the webinar but, as is always the case, we didn't have enough time to get to all of them.

So, we thought it would be good to post some short answers to the questions we received to share them here on our blog.

Question #1: My organization is exploring how we can add behavioral data to detect fraud earlier and I was curious how can real-time data be leveraged to minimize fraud?

We covered this a bit during the webinar but given that we are in a digital-first world the majority of the important inputs to any fraud detection models will come from a bank's digital, owned properties. David provided an example during the webinar about how you can obviously tell if someone isn't who they say they are when you're in a branch, but that goes away when it is someone connecting digitally.

Many of our banking clients are already leveraging the behavioral data they capture in the digital channels using our patented 'Capture capability' which instantly feeds their data into the models being used to identify fraud. The outputs of those models are then delivered immediately as well to ensure that fraud is stopped as quickly as possible. This is all enabled by the actual data model, a published data schema; and the 'Connect capability' allows them to structure the output exactly as their models require. This eliminates all the heavy lifting typically required when you try to merge digital data into data science. You can read more about our approach for Data Science here.

Question #2: In your experience with financial services clients, what have you found to be the number one factor that is preventing banks from being able to deliver decisions in real-time?

Two comments came forth from the webinar on this question:

- Access to Data

- Organizational Silos

We discussed some of the data challenges in the webinar, but banks have many disparate systems with quite a bit of valuable customer data that sit behind the firewall. Also, given the granularity of data required to be captured digitally during application processes, traditional tag-based analytics vendors will struggle to not only capture the data needed but also in providing that in the appropriate timelines.

Organizationally, the challenge comes in getting alignment across different business units who either own the particular product offering or the channel where that the content is displayed. It is difficult to get everyone aligned on what decisions you're going to make, on what digital data, and why those use cases deserve to be prioritized out of the gate. I mentioned the 3 pillars to real-time on the webinar, and the one pillar that proves to be challenging when you have so many voices involved is the "how are you going to make this change on the digital channel in question?" pillar.

Question #3: How can I tell if a vendor's data will be fast enough for the use cases we want to deliver?

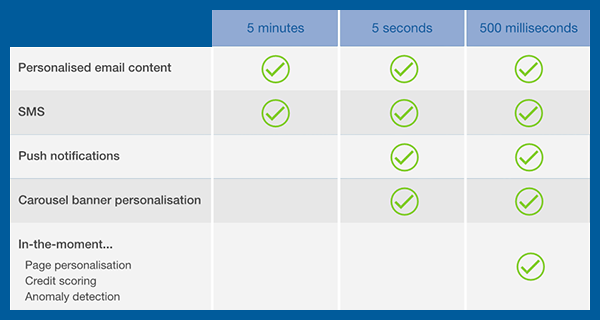

An industry challenge today, in addition to the variable definition of "real-time," is that all vendors claim that they do real-time on their marketing materials. As we discussed on the webinar, the precise definition is less important and you will unlock better insights about what is best for your organization by being focused upon your use cases and being clear with the business about when you need the data to satisfy those use cases. From there, you can agree up front what the desired latency tolerance is for each case.

The only true way to validate whether the solution(s) you choose to evaluate are able to deliver on promises being made is from running a focused, well-defined proof of concept (POC). D4t4 Solutions recommends this approach and we have run countless pilots for our clients to give them the confidence and proof points they need to reassure the business and demonstrate the clear ROI and value for each use case. We are always happy to prove that our platform delivers on the statements we make.

Question #4: We are looking at integrating behavioral data from mobile next. What are the potential pitfalls we should be aware of?

Mobile is a struggle for many of the traditional web analytics and tag management vendors. The over-reliance on things such as data layers (read more here) simply can't deliver on a mobile channel.

Given how personal a mobile phone is to an individual, and the fact that much of the web's functionality and processes have made their way to the mobile apps, capturing mobile data to the same level of granularity as web data is becoming a major focal point for banks (and everyone else!) who want to deliver 'personalization at scale' to all their customers.

Having a complete customer profile across channels and devices at the ready for your use requires that you build a single source of truth for digital data without the need for heavy tagging, ETL, or other coding. Our platform provides this out-of-the-box with our deployment options on both channels, and the data is backed by a relational data model that does all the stitching for you automatically once you know who the individual is.